Welkom bij Colour your Life

De levende natuur en onze Aarde zijn mijn onuitputtelijke inspiratiebronnen. Ik geef ze in kleur en vorm een plaats op het doek. Wat voor kleur geef jij je leven?

Wil je mijn werk zien?

Colour your Life

Met mijn kleurrijke schilderijen haal je natuur in huis

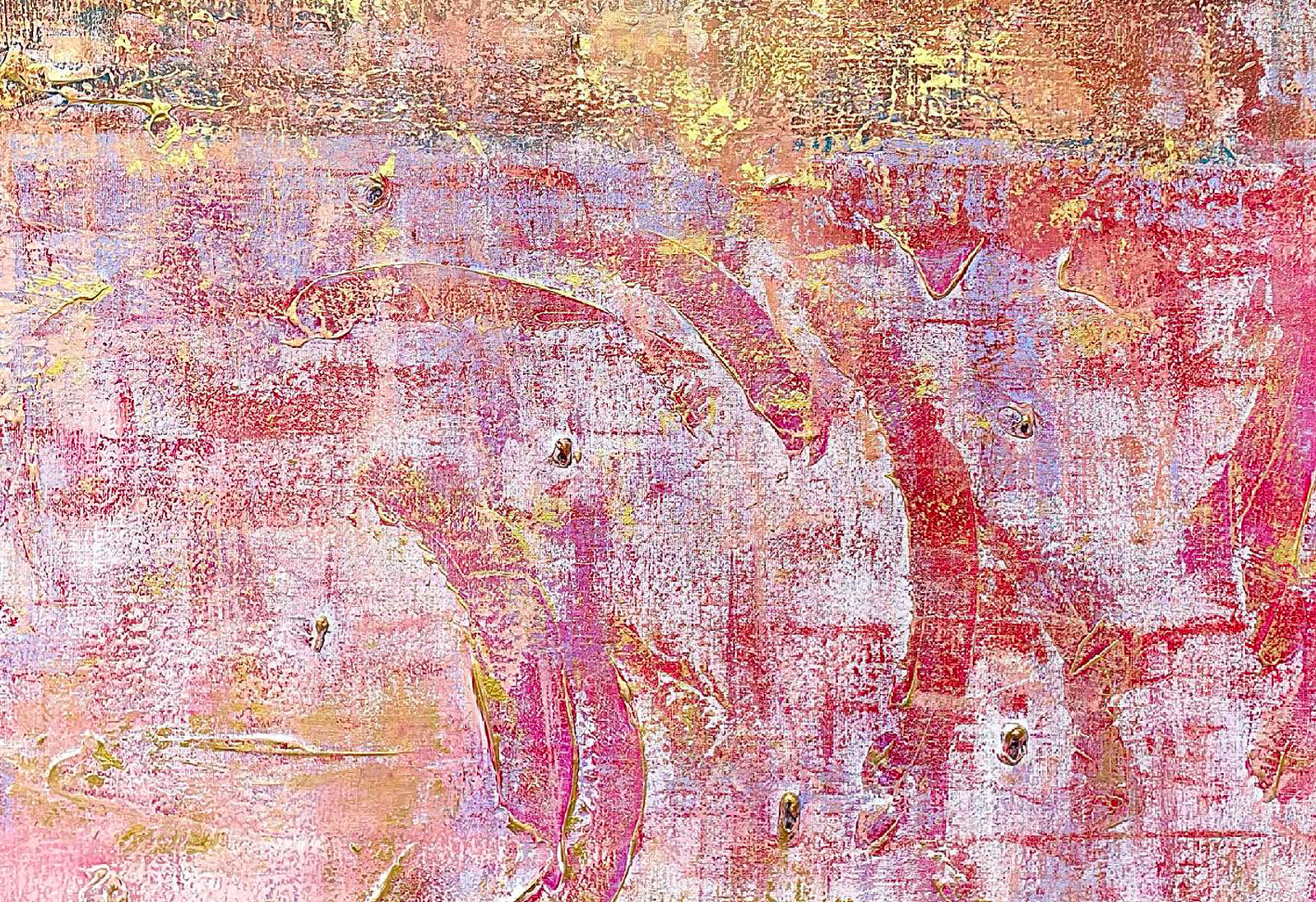

Mijn schilderijen zijn groot, stoer en abstract expressionistisch. Visuele gedichten, ingegeven door de natuur. Met de vele lagen, vaak ‘topped with gold’, geven ze de diepte en rijkdom van de levende natuur weer. Ze schijnen je tegemoet en geven je het rijke gevoel van ons magische leven, vol met verrassingen, de goede en nare, ‘all part of the deal’…

Abstracte kunst kan je ziel raken, voor iedereen op een andere manier. Zoals je weet: kunst is verbeelding, als je verbeeldingskracht in je leven brengt zie je weer onbegrensde mogelijkheden en gaat alles stromen.

Abstract

Natuur

Opdracht

Prints

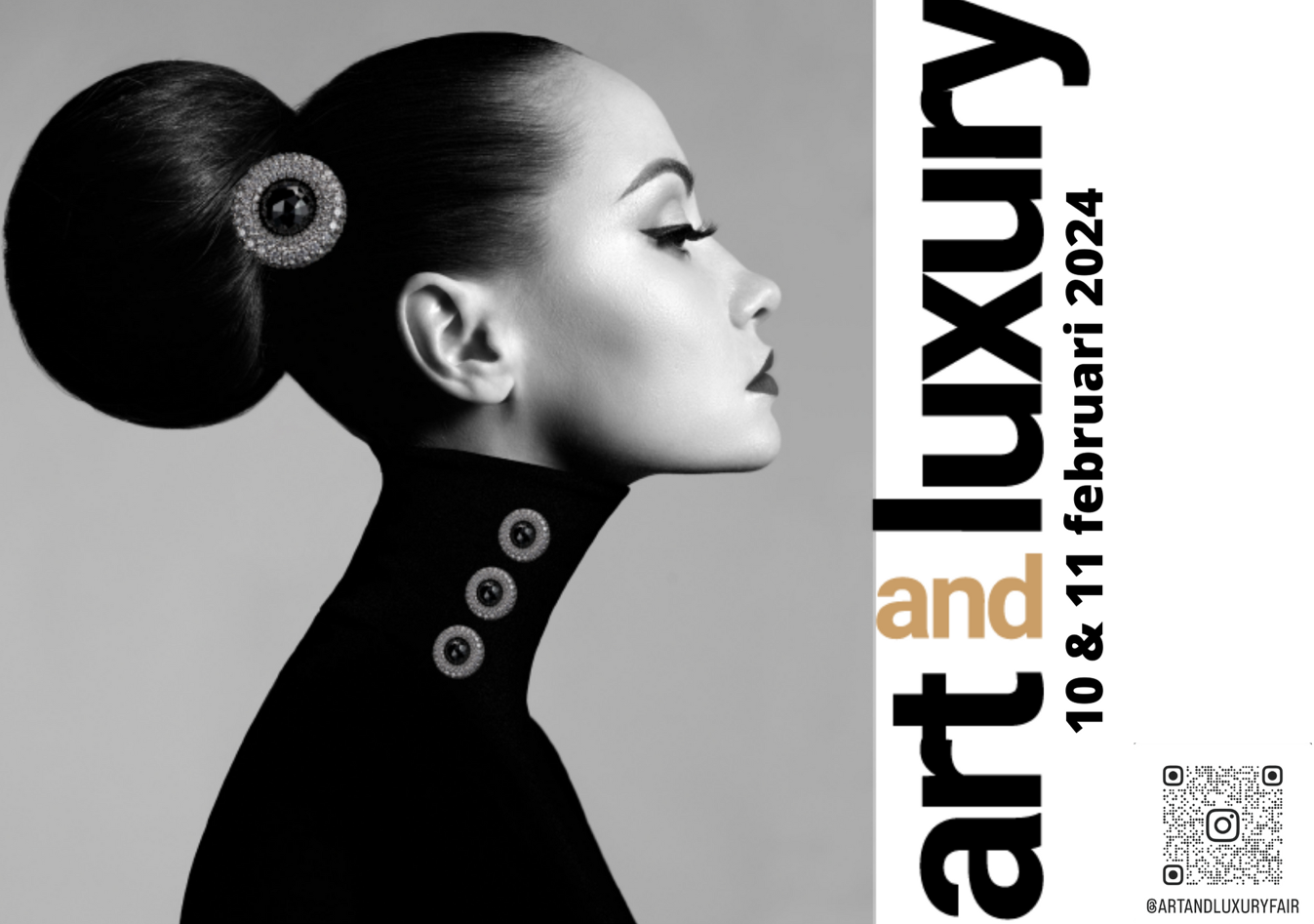

Kom je ook naar de Art and Luxury Fair?

10 en 11 februari in Grand Hotel Huis ter Duin Noordwijk

Welkom in mijn wereld, het moment van creatie waarin ik volledig gefocust en aanwezig ben. Hier een fase van mijn abstracte weergave van de Aarde. Wil je het eindresultaat zien? Van harte welkom 10 en 11 februari op de ART and LUXURY FAIR van 12 – 18 uur. Kan ik je op de gastenlijst zetten? Neem even contact op voor registratie.

Naast exposities met kunst-, fashion en lifestyle zijn er demonstraties van kunstenaars, rondleidingen, lezingen en proeverijen. Bij deze fair staat beleving centraal: je wordt door kunstenaars meegenomen in het creatieve proces en komt zo in direct contact met de makers die vakmanschap in Nederland representeren.

Je vindt mijn kunst in Amsterdam, New York, London, Paris, Berlijn, Milaan, Venetie, Sydney, Dubai, USA en Europa.

Werk in opdracht

Met mijn schilderijen haal je positieve energie en kleur in je leven. Geef kunst een prominente plaats in jouw kantoor of huis. Naast mijn eigen schilderijen werk ik ook in opdracht. Een uniek schilderij aan de muur dat iets toevoegt en past bij de uitstraling van de desbetreffende ruimte is niet gemakkelijk te vinden. Zeker als het iets bijzonders moet zijn. Ik maak kunst in opdracht om jouw specifieke wensen te realiseren. Kunstwerken in opdracht die qua kleur, stijl en ontwerp volledig aansluiten op jouw filosofie en de ruimte waar het kunstwerk komt te hangen. Naast zakelijke klanten maken ook particulieren gebruik van mijn diensten.

Mijn ‘Girl with a Pearl’

Heeft in 2023 als winnaar bij het origineel in het Mauritshuis gehangen, wat een eer!!

Wil jij in het bezit komen van een Pearl Artwork?

Bij de creatie van mijn Meisje met de Parel was ik vooral geinspireerd door de kracht van de parel, gevormd door de natuur. Vandaar dat ik deze groot heb weergegeven… gaat het bij dit kunstwerk om het meisje of de parel? Ik heb onderzocht wat de betekenis van de parel is in de historie. Daarbij kwam ik achter een aantal mooie bevindingen. Deze staan omschreven aan de binnenzijde van de mooie A5 parelmoer kaarten.

PS: wist je dat ik haar in tegenstelling tot mijn grote schilderijen met verf, digitaal heb gemaakt?

Lees er meer over op de Pearl pagina.